Contractors in building and construction

Independent contractors (contractors) are common in the building and construction sector.

Businesses and people who engage contractors should understand the laws that apply before engaging them.

On this page:

- Differences between contractors and employees

- Contractors in the residential building sector

- Confirming if someone is a contractor

- Sham contracting

- Case studies for contractors in building and construction

- How to use this information

- Tools and resources

- Related information

Differences between contractors and employees

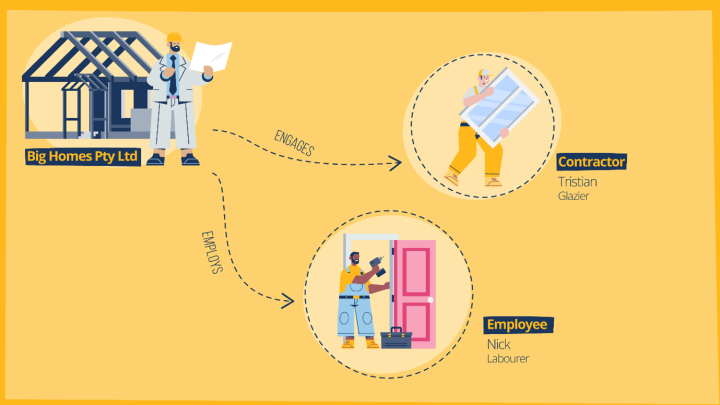

Both contractors and employees can work in building and construction, but different rights, entitlements and protections will apply to them.

Contractors

Contractors provide services to another person or business. They aren’t employed by that person or business. For example, a builder could engage a concreter who has their own concreting business to lay concrete.

Contractors can work for:

- themselves (also known as a sole trader) – for example, a bricklayer

- their own business – for example, a scaffolding company.

For more information about the difference between contractors and employees, visit Independent contractors.

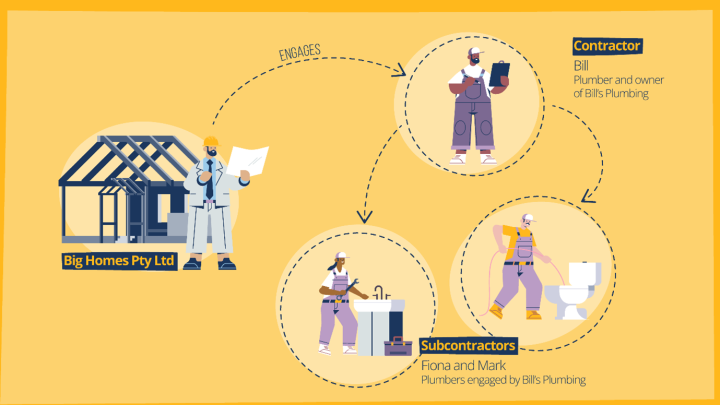

Subcontractors

Contractors may be able to hire other contractors to work for them. These other contractors are called subcontractors or subbies.

Subcontractors have the same legal protections as other contractors. This includes protection from adverse action and the right to belong (or not belong) to an industrial association, like a union.

Myth: Contractors don’t always have control over their work

Myth: Contractors don’t always have control over their work

Contractors usually have control of how they perform their work, including if they can delegate or subcontract their work to others. Contractors can also have more freedom about their hours of work and where they work.

If a contractor doesn’t have control over their work, this may be an indicator that they’re not a contractor and are actually an employee.

Employees

Employees are people employed to provide labour to a business in exchange for money. Most employees are covered by an award or enterprise agreement that sets out their minimum entitlements, such as pay rates, breaks and allowances.

Contractors don’t get these entitlements. This is because they are self-employed and are covered by different laws, including the Independent Contractors Act 2006.

Learn more about minimum entitlements for employees at Workers in building and construction.

Myth: Some employees need an ABN to work

Myth: Some employees need an ABN to work

An Australian Business Number (ABN) is a unique number that identifies a business to the government and other businesses. Employees don’t typically need an ABN.

You’re only required to get an ABN if you genuinely want to become a contractor or start your own business. Just because others in your industry have ABNs doesn’t mean you need one.

If a business requires you to get an ABN but says you’re an ‘employee’, be careful of these offers. This may be a way for a business to lower their costs by engaging ‘contractors’ but treating them like employees.

Apprentices and trainees

Apprentices and trainees can’t be contractors – they must be employees.

Contractors in the residential building sector

Workers in the residential building sector can be contractors or employees. There’s no requirement for a worker on a residential building site to be a contractor.

Residential building work sites may have fewer workers and smaller teams. There may be chains of contractors on residential sites, with some contractors engaging other contractors or employees. For example, a:

- builder engaging a carpentry company as a contractor

- carpentry company engaging a carpenter as a subcontractor

- carpenter engaging an apprentice as an employee.

The working environment on residential sites may be different to commercial building sites, but the general rules about whether a worker is a contractor or an employee are the same.

Table: Differences between a contractor and employee in residential building sector

The table below gives examples of the differences between employees and contractors in the residential building sector.

It shouldn’t solely be used to make decisions about if a specific worker is a contractor or an employee. Make sure you also read How to confirm if someone is a contractor.

| What the work looks like | Contractor | Employee |

|---|---|---|

| How they’re engaged |

|

|

| Where the entitlements come from |

|

|

| Pay and conditions |

|

|

| Control over work |

|

|

| Risk and responsibility |

|

|

| When work is performed |

|

|

| Tools and equipment |

|

|

| Ongoing work |

|

|

| Engaging other workers |

|

|

Confirming if someone is a contractor

There are different tests used to determine if a person is a contractor or an employee. These are the:

The test that’s used will depend on:

- the type of business

- where the business is based.

It’s important for businesses and workers to know which laws apply to them.

Myth: Being called a ‘contractor’ makes you a contractor

Myth: Being called a ‘contractor’ makes you a contractor

Having a contract – written or verbal – that says you’re a contractor doesn’t mean you’re automatically a contractor.

If your relationship with a business meets the criteria of an employment relationship, using the appropriate test, you’re legally an employee. In many cases, being called a ‘contractor’ in a contract (particularly a written one) won’t change this.

A business also can’t just decide to treat you as a contractor. You must agree to be a contractor as well as to the terms of your engagement with the business.

Whole of relationship test

The whole of relationship test determines if a worker is a contractor or an employee by considering:

- the real substance, practical reality and true nature of the relationship

- all parts of the relationship between the parties, including the terms of the contract and how the contract is performed in practice.

This means considering the whole relationship, not just the terms of the contract. Read more about the test and how to use it at Whole of relationship test.

Who uses this test

From 26 August 2024, a business must use this test if they’re:

- a company, usually with Pty Ltd or Ltd at the end of the name, or

- a sole trader or partnership based in the Australian Capital Territory or the Northern Territory.

These businesses are called constitutionally covered businesses.

For work performed before 26 August 2024, constitutionally covered businesses use the start of relationship test.

Opting out of the test

A person who earns above the contractor high income threshold can choose to opt out of using the whole of relationship test and use the start of relationship test instead.

Learn more at Opting out of the whole of relationship test.

Start of relationship test

For the start of relationship test, whether a worker is a contractor or an employee will depend on what was agreed at the start, or before the start, of the relationship.

This will usually be in the form of a contract, which can be:

- written

- verbal, or

- a mix of both.

Changes made after the relationship starts won’t usually be relevant in determining the nature of the relationship.

Read about the test and how to use it at Start of relationship test.

Who uses this test

A business must use the start of relationship test if they’re a sole trader or partnership based in:

- New South Wales

- Queensland

- South Australia

- Tasmania, or

- Victoria.

These businesses are called state referred businesses.

The start of relationship test is also used by constitutionally covered businesses when determining if a worker is a contractor or an employee:

- before 26 August 2024, or

- if the worker has opted out of the whole of relationship test.

Sham contracting

It’s illegal for a person or business to represent to a worker that their relationship is a contracting arrangement rather than an employment relationship when the person or business doesn’t reasonably believe this. This is called sham contracting.

It’s also illegal to:

- knowingly say something false to convince an employee to become a contractor to do the same work (or mostly the same work), or

- dismiss or threaten to dismiss an employee to engage them as a contractor to do the same work (or mostly the same work).

If you’re currently being treated as a contractor but think you’re an employee, go to Sham contracting.

We provide advice on what to do next and where to get help.

Case studies for contractors in building and construction

We have case studies that provide practical guidance on the following scenarios:

- a business reviews their contractors against the new definition of employment

- a person is engaged as an independent contractor when they should have been an employee and demonstrates what the outcomes might be

- an example of a genuine contractor.

Visit Case studies for contractors in building and construction.

How to use this information

How to use this information

It’s critical that businesses know when and how laws apply when engaging contractors.

Follow the advice and tips to:

- understand the differences between contractors and employees

- learn more about engaging workers

- know the protections for contractors

- get help with entitlements and disputes.

Understand the differences between contractors and employees

Working out if someone is a contractor or an employee can be complicated. Each situation is different and it will depend on the specific circumstances.

Understand the differences between contractors and employees by:

- learning about the different factors and tests that apply at Independent contractors

- reading our Case studies for contractors in building and construction.

Workers can also use this information to check whether the relationship is an employment or contracting relationship. There are examples for the different factors to consider and help you make an assessment.

We (the Fair Work Ombudsman) can’t decide if someone is a contractor or an employee.

If you need confirmation about whether someone is a contractor or an employee, you should get legal advice. Find out how at Legal help.

Learn more about engaging workers

Businesses may engage employees, contractors or both.

Want to engage a contractor? We recommend you:

- use our guide at Managing your labour contracting

- read the business.gov.au information about Contractor rights and protections

- access the free business.gov.au How to prepare a contract guide.

Want to hire an employee? Find more information and helpful tools by:

- visiting Hiring employees

- reading Working in building and construction

- using the business.gov.au Hiring employees checklist or Employment Contract Tool.

Know the protections for contractors

Under workplace laws, contractors have specific rights and protections.

Contractors are protected under the Fair Work Act from:

- adverse action

- coercion

- abuses of freedom of association.

Learn more at Protections at work.

Get help with entitlements and disputes

Contractors have different entitlements and rights.

We can help with:

- sham contracting, where an employee believes they’ve been misclassified as a contractor

- employee entitlements.

There are some issues that we can’t help with. This includes:

- telling you if a worker is a contractor or an employee

- disputes about payments

- unfair contracts.

To find out where to get help with these issues as a contractor, go to Contractor entitlements and support.

You can also find information about where to get help with other issues in the building and construction sector at Other help available.

Tools and resources

- business.gov.au – Employment Contract Tool

- business.gov.au – How to prepare a contract guide

- business.gov.au – Contractor rights and protections

- Guide to labour contracting Guide to labour contracting